Weekly Market Performance — July 3, 2025

Last Updated: July 03, 2025

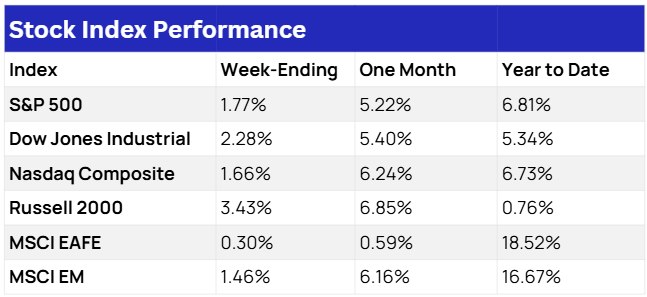

LPL Research provides its Weekly Market Performance for the week of June 30, 2025. U.S. stocks capped the holiday-shortened week with fireworks of their own, extending weekly gains and scoring the third record high of the week of the S&P 500. A better-than-feared jobs report fueled risk on sentiment heading into the long weekend, underpinned by upbeat trade headlines. Overseas, European markets traded relatively flat through Thursday as monetary policy and U.K. politics stepped into focus while major Asian markets were mixed so far on the week. Treasuries traded lower this week as yields advanced, and the broader commodities complex surged on Wednesday and Thursday.

Source: LPL Research, Bloomberg 07/03/25 @12:05 p.m. ET

Disclosures: Indexes are unmanaged and cannot be invested in directly.

U.S. and International Equities

U.S. Equities: Major U.S. averages powered higher during the holiday shortened week, with the S&P 500 capping its best quarter since December 2023, a solid first half, and kicked off the third quarter on a positive note. The equity benchmark logged its second consecutive all-time high Monday on upbeat trade headlines and end-of-month, quarter-end, and half-year institutional rebalancing dynamics. Wall Street bulls briefly paused their risk-on mood and market participants took note of a notable momentum unwind as investors rotated away from second-quarter winners (namely big tech) on Tuesday. Nonetheless, another record high was logged Wednesday as stocks overcame morning weakness from a surprise negative ADP payrolls print, moving higher after the White House announced a trade deal was reached with Vietnam. The agreement includes a 20% overall tariff and a 40% levy for transshipments, while Vietnam dropped all duties on U.S. imports — buoying apparel and footwear makers on hopes supply-chain turmoil may be less than feared. To cap the holiday week, stocks jumped after a better-than-feared June payrolls report, providing investors with a something else to celebrate over the Independence Day weekend.

International Equities: European stocks hugged the week-to-date flatline through Thursday’s session, bouncing back from notable mid-week weakness. Monetary policy was in focus after preliminary June Eurozone inflation ticked up to 2.0%, as expected, fueling arguments for policy makers to pause their year-long rate cutting campaign. Meanwhile, the U.K. stepped into the spotlight as Prime Minister Starmer’s welfare reform plans fell apart, leaving a £4.5 billion hole in the fiscal outlook. U.K. assets slumped on Wednesday after Starmer failed to guarantee finance minister Rachel Reeves’ position, before the British pound, Gilts, and stocks pared back Wednesday slide after Starmer backed Reeves Thursday morning. In corporate news, shares of Siemens jumped after the U.S. Commerce Department lifted requirements for semiconductor design software sales in China, while M&A headlines were an additional bright spot.

Asian equities were mixed ahead of the final session of the week. South Korea led week-to-date gains, receiving a lift on hopes of commercial law revisions set for a vote in parliament as well as read-throughs from tech outperformance on Wall Street. Stronger tech shares also supported Taiwan through Thursday and helped pad losses in its fellow-tech-heavy market of Japan. Japanese indexes churned with President Trump’s trade negotiation criticism and threats of a maximum 35% tariffs dampening risk sentiment with next Tuesday’s trade deadline quickly approaching with the President underscoring his intention to keep the deadline firm. Mainland China gained ground and Hong Kong traded lower, weighed down in Thursday’s session on concerns around the U.S. agreeing to a 40% transshipment levy with Vietnam on goods from China. Elsewhere, the Australian equity benchmark S&P/ASX 200 scored a fresh record Wednesday on rate cut hopes.

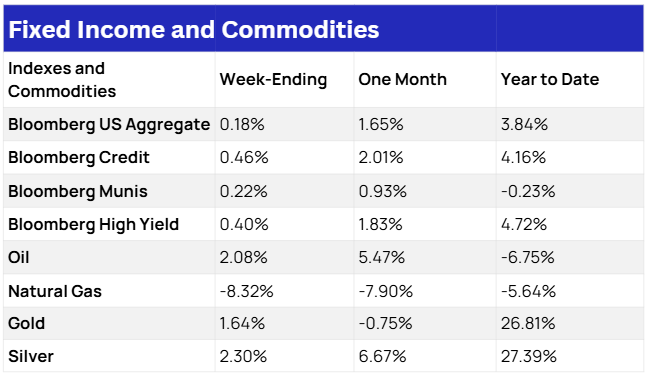

Fixed Income, Currency, and Commodity Markets

Fixed Income: The Bloomberg U.S. Aggregate Index traded lower this week. The monetary policy rate-sensitive two-year yield and the 10-year yield ended roughly 12 and six basis points higher, respectively. U.S. fixed income investors have (quietly?) enjoyed a solid start to the year, with the Bloomberg Aggregate Bond Index (Agg) up over 4% through June 30. The 4% return for the Agg is the best start to the year since 2020, when the index was up nearly 6% through June 30. Moreover, the 4% return is the fifth best first-half start for the index over the last 20 years. Returns are a combination of coupons (1.9%) and price appreciation (2.1%), so the index has, so far, outperformed coupon expectations. Within the Agg, all sectors were positive, with mortgage-backed securities (MBS) outperforming investment-grade corporates and Treasury securities. Notably, Treasury yields are lower than they were to start the year, despite the narrative that Treasury securities were losing their haven status. The 10-year Treasury yield is lower by 0.38% so far this year, which is the largest drop in yields among developed nations, with most countries experiencing rising 10-year yields. However, at 4.19%, the 10-year Treasury yield is higher than every other developed market 10-year yield except New Zealand (4.47%) and the U.K. (4.22%). And as President Trump has noted repeatedly, the U.S. central bank’s policy rate is still among the highest in the developed world. While returns for the Agg have been strong so far this year, we think Treasury yields are going to be rangebound around current levels going forward, so we think a coupon +/- type return is realistic for the second half of the year

Commodities and Currencies: The broader commodities complex traded higher through midday Thursday, with the Bloomberg Commodities Index surging Wednesday afternoon and Thursday morning. West Texas Intermediate (WTI) crude oil jumped as a modest risk premium returned to prices after Iran suspended cooperation with the United Nations (U.N.) nuclear watchdog. A falling dollar continued to support oil, although a surprise increase in U.S. inventories capped gains amid the first sign the market may lean oversupplied as a result of OPEC+ production increases. Elsewhere, gold moved higher over the last four days continuing to receive support from U.S. fiscal concerns following the Senate passage of the One Big Beautiful Bill Act, paring back week-to-date gains amid surging Treasury yields and a lower dollar on Thursday. The dollar continued to weaken since Monday, while the British pound also weakened amid this week’s U.K. political woes.

Economic Weekly Roundup

Businesses Continue to Expand Payrolls. The private sector grew payrolls in June, strongly supported by health care firms. June payrolls grew by 147,000 after rising a revised 144,000 in May. Federal payrolls shrank by 7,000, where employment is down by 69,000 since reaching a recent peak in January (employees on paid leave or receiving ongoing severance pay are counted as employed in the establishment survey). Health care added 39,000 jobs in June, similar to the average monthly gain of 43,000 over the prior 12 months. Employment showed little change over the month in other major industries. The unemployment rate dipped to 4.1% and has remained in a narrow range of 4.0% to 4.2% since May 2024. In June, the number of long-term unemployed (those jobless for 27 weeks or more) increased by 190,000 to 1.6 million, largely offsetting a decrease in the prior month. The long-term unemployed accounted for 23.3 percent of all unemployed people.

If businesses keep expanding payrolls like they’ve done so far this year, the Fed can comfortably sit in “wait and see” mode at the upcoming policy meeting. Uncertainty around tariffs and trade have apparently not spooked businesses into shedding workers. One note of caution: the administration is still actively negotiating details with several major trading partners and the eventual business impacts are unknown.

ADP Reported Negative Payrolls. ADP reported a decline in private payrolls, the lowest reading since March 2023. ADP’s forecasting value is minimal on a monthly basis, yet still helpful in determining long-term trends. The decline in June was driven by small and medium cap, service-producing companies. In contrast, large companies (500+ employees) added to payrolls in June, an interesting development from an asset allocation perspective. Labor market churn will likely slow as workers find it less attractive to change jobs in search of higher pay.

The Week Ahead

The following economic data is slated for the week ahead:

Monday: No economic releases scheduled

Tuesday: NFIB Small Business Optimism (Jun), New York Fed One-Year Inflation Expectations (Jun), Consumer Credit (May)

Wednesday: MBA Mortgage Applications (Jul 4), Wholesale Trade Sales (May), Wholesale Inventories (May final), FOMC Meeting Minutes (Jun 18)

Thursday: Initial Jobless Claims (Jul 5), Continuing Claims (Jun 28)

Friday: Federal Budget Balance (Jun)

Important Disclosures

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors. To determine which investment(s) may be appropriate for you, please consult your financial professional prior to investing.

Investing involves risks including possible loss of principal. No investment strategy or risk management technique can guarantee return or eliminate risk.

Indexes are unmanaged and cannot be invested into directly. Index performance is not indicative of the performance of any investment and does not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

This material was prepared by LPL Financial, LLC. All information is believed to be from reliable sources; however LPL Financial makes no representation as to its completeness or accuracy.

Unless otherwise stated LPL Financial and the third party persons and firms mentioned are not affiliates of each other and make no representation with respect to each other. Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services.

Asset Class Disclosures –

International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

Bonds are subject to market and interest rate risk if sold prior to maturity.

Municipal bonds are subject and market and interest rate risk and potentially capital gains tax if sold prior to maturity. Interest income may be subject to the alternative minimum tax. Municipal bonds are federally tax-free but other state and local taxes may apply.

Preferred stock dividends are paid at the discretion of the issuing company. Preferred stocks are subject to interest rate and credit risk. They may be subject to a call features.

Alternative investments may not be suitable for all investors and involve special risks such as leveraging the investment, potential adverse market forces, regulatory changes and potentially illiquidity. The strategies employed in the management of alternative investments may accelerate the velocity of potential losses.

Mortgage backed securities are subject to credit, default, prepayment, extension, market and interest rate risk.

High yield/junk bonds (grade BB or below) are below investment grade securities, and are subject to higher interest rate, credit, and liquidity risks than those graded BBB and above. They generally should be part of a diversified portfolio for sophisticated investors.

Precious metal investing involves greater fluctuation and potential for losses.

The fast price swings of commodities will result in significant volatility in an investor's holdings.

This research material has been prepared by LPL Financial LLC.

Not Insured by FDIC/NCUA or Any Other Government Agency | Not Bank/Credit Union Deposits or Obligations | Not Bank/Credit Union Guaranteed | May Lose Value

For Public Use – Tracking: #764098